are withdrawals from a 457 plan taxable

A 50 nondeductible excise tax. All contributions to 457 plans grow tax-deferred until retirement when they are either rolled over or withdrawn.

Everything You Need To Know About A 457 Real World Made Easy

Money saved in a 457 plan is designed for retirement but unlike 401 k and 403 b plans you can take a withdrawal from the 457 without penalty before you are 59 and a half years old.

. However once you start making withdrawals you will owe certain taxes. At 50 that limit increases. For this calculation we assume that all contributions to the retirement account were made on a pre.

All withdrawals are taxable. If you have a 457 f plan at a private non-profit be prepared for. All contributions to 457 plans grow tax-deferred until retirement when they are either rolled over or withdrawn.

How much can I withdraw from my 457 plan. In fact a governmental 457b plan may elect to permit systematic withdrawals and rollovers out of the plan. Now if this were a 457b plan of a PRIVATE tax-exempt such as a.

Basically for every amount you withdraw from your 401 k account 20 taxes will be withheld and if youre under 59 and a half youll be. 457 plans are the only retirement plan that does not require you to wait until a certain age to avoid an IRS penalty on withdrawals. Are 457 plan withdrawals taxable.

These vary from one year to the next but for 2019 youre limited to 19000 if youre under the age of 50. All withdrawals are taxable regardless of the participants age. All money you take out of the account is taxable as.

Are 457 plan withdrawals taxable. At 50 that limit increases. Once you retire or if you leave your job before retirement you can withdraw part or all of the funds in your 457 b plan.

Mar 13 2022 - Learn how withdrawals from 457 deferred-compensation plans are taxable but not subject to the same rules and restrictions as 401k and 403b plans. What you really want to be asking if you can roll money over from a 457 b to a Roth IRA. However if you withdraw from your.

You can withdraw funds from your 457b plan penalty-free at any age once you leave your employer or retire. What are the Withdrawal Rules From My 457 Plan. How much can I withdraw from my 457 plan.

A 60-year-old retiree starts withdrawing immediately from their 1. The answer to that is Yes you can roll over any amount you want as often as you want. All contributions to 457 plans grow tax-deferred until retirement when they are either rolled over or withdrawn.

See 457 b Plan Contribution Limits. Similar to 401ks and 403bs all contributions into 457 plans grow tax-free but early withdrawals are not penalized. Are distributions from a state deferred section 457 compensation plan taxable by New York State.

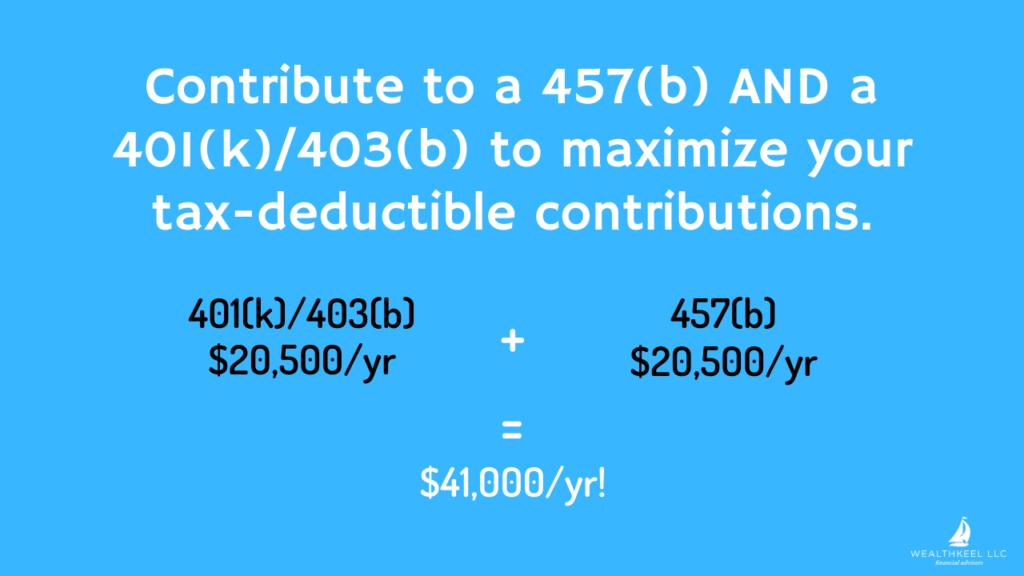

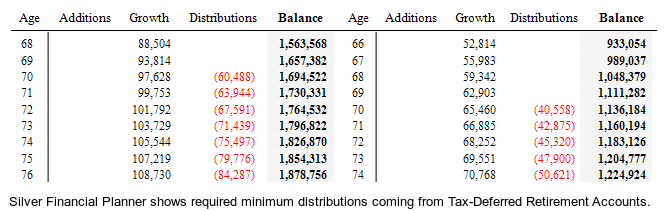

Theres a hefty penalty for failing to take a required minimum distribution. So if you have the option of a 401 k and a 457 and youre under the age of 50 you can contribute up to 38000 a year between the two plans. These vary from one year to the next but for 2019 youre limited to 19000 if youre under the age of 50.

All withdrawals are taxable regardless of the participants age. However distributions received after the pensioner turned 59 12 would. All withdrawals are taxable.

Withdrawals from 457 plans are taxable but early withdrawals are not punished.

Can I Max Out My 401k And 457 Here S How It Works

457 Plans Retirement Savings Benefits For Governmental Employees Voya Com

:max_bytes(150000):strip_icc()/taxes-in-retirement-how-much-will-you-pay-2388083v-6-5b4cba9fc9e77c0037315bd8-8ed4f6b983744e1ba2e910636aa65873.png)

Estimating Taxes In Retirement

What Is A Deferred Compensation Plan Ramsey

:max_bytes(150000):strip_icc()/GettyImages-1131086835-83fd238d51f44798943a4e69c1198537.jpg)

457 Plan Vs 403 B Plan What S The Difference

The Hierarchy Of Tax Preferenced Savings Vehicles

In Service Distributions From Gov T 457 B Plans Retirement Learning Center

457 Vs Roth Ira What You Should Know 2022

Social Security Changes For 2013 And Faqs On 403 B And 457 Plans National Association Of Plan Advisors

Sec 457 F Plans Get Helpful Guidance Journal Of Accountancy

457 Deferred Compensation Plan White Coat Investor

What Is A 457 B Plan How Does It Work Wealthkeel

457 Deferred Compensation Plan White Coat Investor

457 Deferred Compensation Plan White Coat Investor

How To Utilize Your Non Governmental 457 B Plan White Coat Investor

457 Deferred Compensation Plan White Coat Investor

Retirement Plan Required Minimum Distributions Rmds Moneytree Software